Pay zero taxes with a Dynasty startup trust

For founders and Investors

(5 Star Reviews)

Eliminate Taxes and

Protect Assets

Nevada is a zero tax state so you will never have to pay income, cap gain, or dividend taxes again. You also get more QSBS eligibility.

Nevada law gives your trust bulletproof asset protection from creditors, lawsuits, and even divorce (better than a prenup).

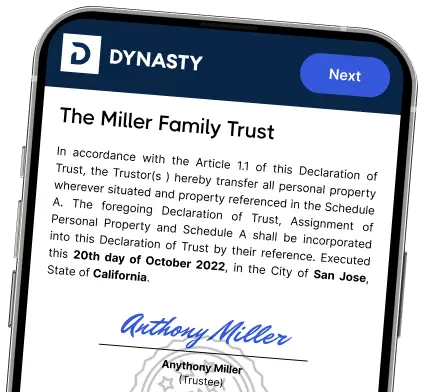

Setup

Create Nevada Dynasty trust.

Assign

Assign a Nevada trustee.

Register LLC

Create LLC holding company owned by the trust(when applicable).

Transfer Assets

Transfer shares and carried interest into the holding company.

Control

Control holding company as “manager”.

Download

Download guide for more details.

How much?

Starting at $999 / year (includes trust creation and annual Nevada Trustee services).

Why Nevada?

Nevada is a zero tax state – zero income tax, zero cap gains tax, and zero dividend tax.

In addition to that, Nevada has the best laws in the US for asset protection and privacy.

For any assets that are in a Nevada trust for at least 2 years, Nevada law protects the trust from all creditors.

Why Dynasty?

Dynasty uses modern day technology to make trust creation simple and affordable.

No need for expensive lawyers or stacks of confusing paperwork.

With Dynasty you get a digital experience that can be completed in minutes, for a fraction of what it normally costs.

QSBS stacking.

Startup founders and early executives can stack trusts to multiply their QSBS benefit.

Instead of capping out at $10 million dollars of tax free capital gains, you can create multiple trusts and get $10 million dollars per trust.

Waterfall Method.

Add the rockefeller “waterfall” method to ensure your wealth grows across multiple generations.

This strategy includes purchasing whole life insurance policies for each beneficiary named in the trust.

Beneficiaries can take out loans against the cash value of their life insurance. And death benefits are paid back to the trust.

Pass wealth tax free.

Nevada law allows for Dynasty trusts to exist for 365 years (40 generations).

The trust gets passed from generation to generation, completely avoiding the 40% death tax.