Nevada Asset

Protection Trust

Talk to an Agent (650) 665-6401

(5 Star Reviews)

Assets in your name are at risk

Divorce is the leading cause of wealth loss for high income individuals. Assets in your name can be considered marital property and may be divided.

If you or a family member are involved in an accident using your property such as a car, all of your assets are at risk from future legal actions.

Without an asset protection trust, your assets are exposed, leaving them vulnerable to creditors and financial ruin in bankruptcy.

Create an Irrevocable Trust which holds assets you control

Fast Setup

Get the process started in a few minutes.

Nevada Trustee

Trust administration is handled by a professional trustee.

Secure Assets

Assets will be legally out of your name and in the Trust.

Limit Liability

Assets under the Trusts are protected from actions against you.

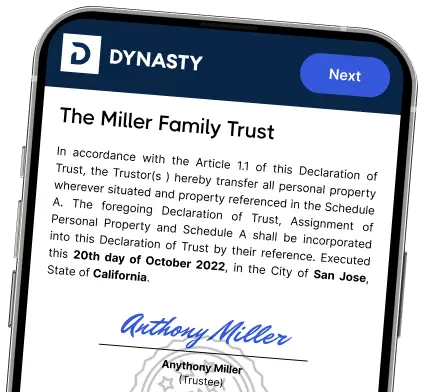

Confirm Your Trustee

Use our Corporate Trustee Partner to oversee the assets and execute requests.

Move Assets

Transferring the assets out of your name and into the Irrevocable Trust is necessary. Our Team can help guide you through the process.

Only intangible assets* can be included in the Trust and will be legally transferred to the state the Trustee resides in.

* Real Estate and physical assets are not supported.

Maintain Control

Depending on the purpose, your Irrevocable Trust can be set up so that you retain the ability to make decisions about the assets even if they have been transferred out of your name.