The easiest way to reduce taxes on investments

(5 Star Reviews)

Your Investments are taxed where you reside

States like Nevada and South Dakota have no state capital gains taxes. Investments held in these states enjoy zero taxes when selling.

Moving investments into an Irrevocable Trust in a state with no capital gains, activity on those investments do not need to pay

Learn more about puttingBrokerage Account in a Trust.

Easy Setup

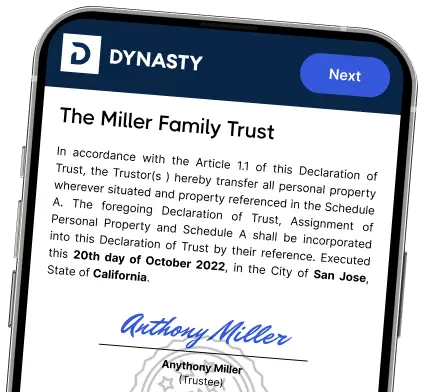

We make creating a Trust and moving your stock easy.

Expert Legal Consultation

Talk over your plans with a Lawyer as part of your onboarding.

Reduce Taxes

The investments will legally be located out of state.

Manage your Trusts

Easily manage all your Trusts through the Dynasty app.

Choose a Trustee

Use our Corporate Trustee Partners or pick someone you know to have the responsibilities of overseeing the assets and executing requests.

Move Assets

Transferring the assets out of your name and into the Irrevocable Trust is necessary. Our Team can help guide you through the process.

Only intangible assets* can be included in the Trust and will be legally transferred to the state the Trustee resides in.

* Real Estate and physical assets are not supported.

Maintain Control

Depending on the purpose, your Irrevocable Trust can be set up so that you retain the ability to make decisions about the assets even if they have been transferred out of your name.